When refinancing your mortgage, banks often offer competitive rates and other benefits that differ from one another. These may include free conversion to another package within the same bank, waiver for early redemption penalty upon sale of property, and cash rewards. As such, it is rare to be able to compare on an apple-to-apple basis. Property owners have to sit down with their brokers to see which bank’s package and features suit their situation the most.

Today, we take a look at one of our recent cases, where the client decided on the package based on its third-year rate.

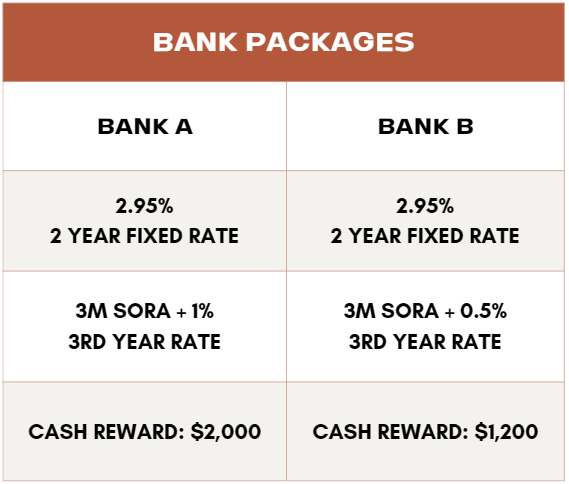

The client had a $450,000 loan that was approaching the end of the lock-in period and wanted to avoid the year 3 floating rate of 4.7%. She approached Bank A, which offered a 2-year fixed rate of 2.95% and a $2,000 cash reward. However, the third-year rate was 3M SORA plus a 1% spread. (3M SORA + 1%)

While it is a great offer, the client wondered if she could get something better. Armed with the offer from Bank A, she contacted us and we got to work.

After comparing offers from several banks, we found that Bank B also offered a 2-year fixed rate of 2.95%, but only for loans of $500,000 and above. More importantly, their third-year rate was 3M SORA plus a 0.50% spread (3M SORA + 0.5%). After negotiations, Bank B extended this package to the client even though her loan was a tad lower than the $500,000 minimum loan requirement for Bank B, and they also offered a $1,200 cash reward.

So now she has 2 packages to choose from:

Both come with Free Conversion after 24 months.

While at first glance, Bank A’s $2,000 cash reward seemed appealing. However, refinancing options may not always be attractive or feasible after the lock-in period. The lower third-year rate from Bank B provides a safety net for that situation, potentially saving $2,250 for the third year, making it a better long-term choice despite the lower cash reward.

In addition, there is a 3-year clawback for cash reward. If the client were to refinance before 3 years, all cash reward given will be clawed back – it does not matter whether she gets $1200 or $2000. On the other hand, if she does not switch to another bank after year 2, she will benefit from the 0.50% lower interest from Bank B.

In the end, the client decided to go for Bank B for the long-term benefits and also its reasonable cash reward.

Third-year rates are often overlooked in favor of other benefits like higher cash reward for example. But it’s essential to look beyond immediate benefits and consider long-term savings and flexibility.

Currently, market expectation is that the interest rate will start coming down within the next twelve months. By the end of second year, if interest rate environment normalises and Floating Rate packages are once again lower than Fixed Rate packages, there’s a high probability this client will remain with the same Bank and pay 0.50% lower interest as compared to Bank A.

After explaining the pros and cons to the client, she was able to decide on the most suitable package for herself.

When refinancing, it is important to work with an experienced mortgage broker who can help you look beyond the upfront perks and focus on other features and longer term rates beyond the first 2 years that might matter more. Sometimes, he will be able to negotiate with certain banks to help you qualify for packages meant for higher loan quantum due to his relationship with the bankers. If you are looking for a home loan, you can get in touch with our mortgage experts for a free consultation via the link in the description below: